Have you thought of launching your own policy based on telematic data?

Are you considering introducing Pay How You Drive, Pay As You Drive or accident detection and reconstruction solutions into your offer?

We offer universal software with a modular architecture that:

– seamlessly integrates with a wide range of telematic devices,

– allows for operating alternative insurance programs based on various business models,

– provides drivers with useful services on the go (VAS – Value Added Services), while facilitating the achievement of the insurer’s goals.

Hardware: we work with all data sources

Our platform is a device agnostic framework, which allows the acquisition and unification of data from various types of peripheral devices, such as applications, standard telematic devices and hybrid solutions (e.g.: application + beacon). It is the insurer themselves who chooses the equipment from all the options available in the market:

- smartphones – today every customer has one on them,

- beacons – a small device glued to the windshield is enough to activate a smartphone app automatically, each time the user gets in a car. They don’t even need to remember to do it. What’s more, a beacon measures the G force acting on the vehicle and is able to detect a collision or an accident in real time, and inform the insurer about it immediately,

- OBDII – easy installation by just inserting the plug into a diagnostic socket, present in all vehicles manufactured after 2003 (as simple as plugging a USB cable to your laptop),

- 12 V – plugged directly to the battery under the hood; installation does not require any expert knowledge, all you need is a simple spanner to attach the battery clamp,

- standard factory systems installed by new car manufacturers in connected vehicles (OEMs) – we are in the process of implementing a solution that will only require a single click to give consent for data processing and grant our system access to vehicle data.

Configure a non-standard financial settlement model with the customer

Some insurance telematics suppliers decide to offer the customer a discount just for the opportunity to analyze their driving style (upfront discount). They believe that the mere fact the driver agrees to be monitored makes them drive more safely.

Others prefer to lower the driver’s insurance premium only after the first year of insurance – as long as they present the desired driving style, of course. The first year is then the period for calculating risk based on the driving style of a given driver and in the case of drivers whose driving behavior leaves much to be desired – may mean increased premiums.

Do keep in mind that telematics brings the insurance industry into the digital world and provides additional opportunities for shaping your customer financial settlements model. Some of the various flexible forms of settlement supported by our platform include:

- cashback – a discount is granted by the insurer in the form of reimbursement of a set percentage of the previously paid premium. The safe driving bonus can consist of smaller amounts summed up every month or be awarded once at policy expiry.

- try before you buy – a short trial period – all that needs to be done to participate is to download and install the app. After driving a set number of kilometers, the customer receives an offer with a discount calculated based on their driving style. This way, they can see for themselves beforehand if this type of policy will be beneficial to them and enjoy the discount already in the first settlement period.

- subscription model – subscriptions are renewable payments for a service. Telematics provides a flexible manner for determining next month’s payment, depending on the driving style of a given driver in the previous month. It additionally increases the drivers motivation to drive safely. When considering this model, it is good to check the regulations in the country where the service is to be provided. For insurance services, it is not always possible to increase the amount of recurring payments.

Not only scoring – additional functions to transform your app into a true customer magnet

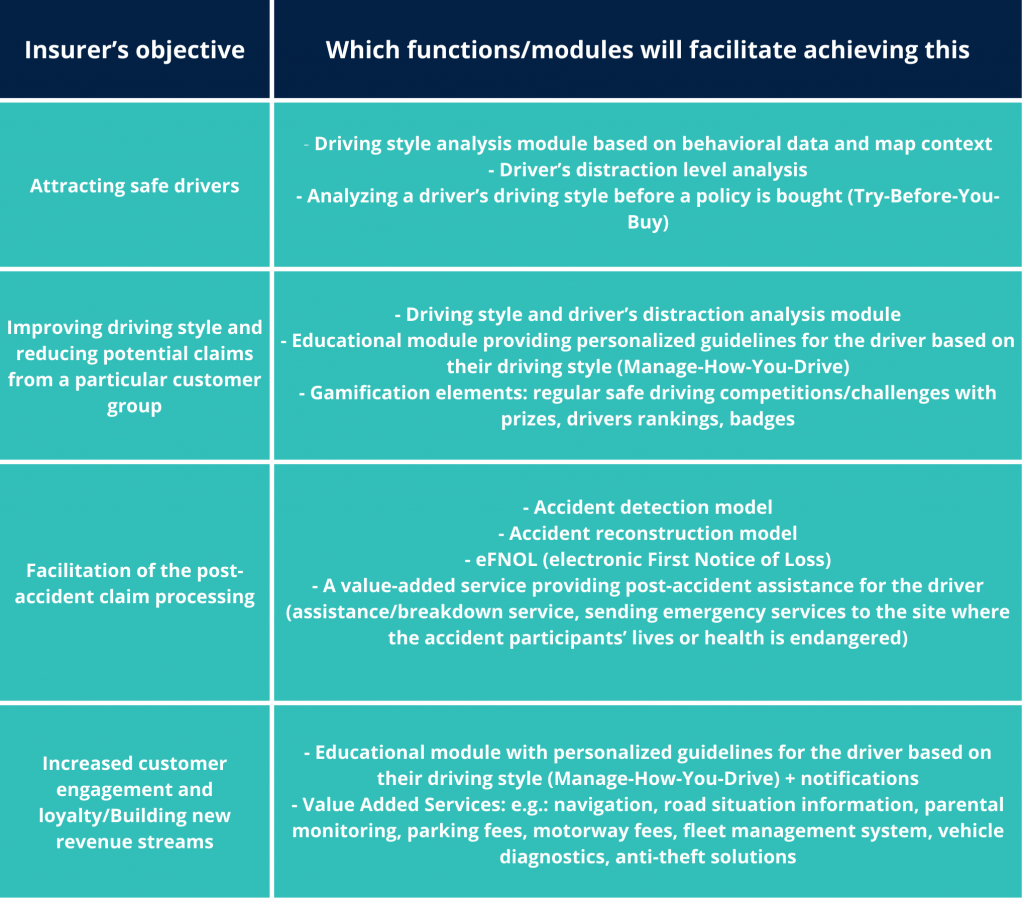

There’s more behind the modular nature of our platform than just free acquisition and processing of data – our system’s strong suit is its adjustability. Depending on the objectives that a given solution is to deliver for the insurer, you can choose a set of functions (or entire modules) to facilitate this delivery. A few examples below:

Data security – for driver and insurer

We process data in accordance with the highest standards and in full compliance with the strictest regulations. We only share data with the entities for which it was collected.

Do you already have your own app for your customers?

Increase its capabilities by adding a telematic data processing feature based on one of our modules.

It takes a lot of expert skills and experience – and a lot of time for trial and error – to build algorithms for every functionality in-house. We’ve gone through all that already – take advantage of our solutions!

The implementation of our SDK makes integration possible. Complete the form below and make an appointment with us to find out when this solution will be most useful.